The Employees’ Provident Fund Organisation (EPFO) has introduced a major update to its pension structure in 2025, promising enhanced financial security for private-sector workers across India. Under this revised scheme, eligible employees will now receive a fixed monthly pension of ₹9,000, a substantial increase from the earlier minimum pension of ₹1,000. This move reflects the government’s ongoing efforts to improve the post-retirement lives of the working class and offer better protection against inflation and rising living costs.

Understanding the EPFO Pension Scheme 2025

The EPFO pension program, formally referred to as the Employees’ Pension Scheme (EPS), serves as a retirement benefit initiative for workers in the organized private sector. Administered by the EPFO, this scheme guarantees financial support after retirement through a regular monthly pension.

The 2025 update is a significant step forward, introducing a fixed monthly pension of ₹9,000 for qualifying individuals. This upgrade aligns with the government’s goal of providing a sustainable and secure retirement option for India’s workforce, especially in the face of growing economic uncertainties.

Key Highlights of the Updated Scheme

Some of the notable features of the updated EPFO Pension Scheme 2025 include:

- A guaranteed monthly pension of ₹9,000 for eligible employees.

- A minimum service requirement of 10 continuous years.

- Joint contributions by employers and employees throughout the worker’s service period.

- The pension is administered under the EPS, part of the larger EPF framework.

- Currently applicable to employees earning up to ₹15,000 per month, with proposals to increase this cap to ₹21,000.

- Provisions for lifelong pension, as well as family and widow pensions in the event of the pensioner’s death.

Who is Eligible?

To benefit from the revised pension scheme, applicants must meet the following eligibility conditions:

- Be a registered member of the EPFO.

- Have completed a minimum of 10 years of service.

- Reach the age of 58 to begin drawing the full pension.

- Early pension withdrawals are allowed from age 50, but with reduced amounts.

- Must have contributed regularly to the EPS during their employment.

- Not be receiving a pension from any other central or state pension scheme.

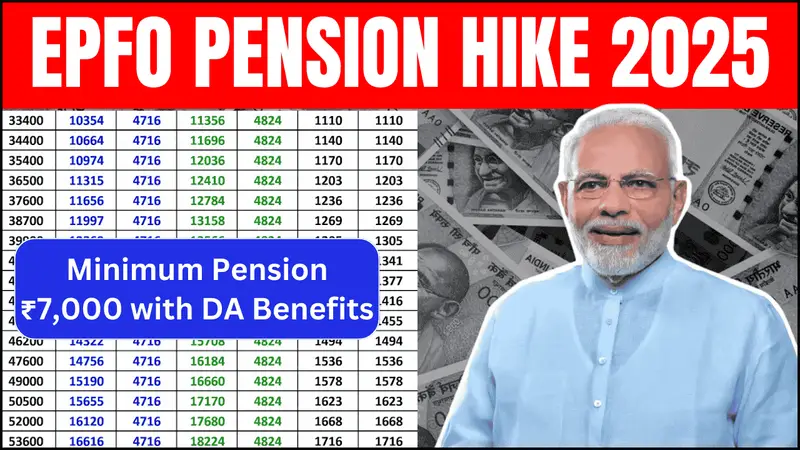

Contribution Breakdown

The EPFO pension scheme is funded through joint contributions made by employers and employees. Here’s how the contribution structure works:

- Employee Contribution to EPF: 12% of basic salary.

- Employer Contribution to EPF: 12% of basic salary.

- From Employer’s Share to EPS: 8.33% of the basic salary.

- EDLI (Employees’ Deposit Linked Insurance): 0.5% of the basic salary by the employer.

This structure means that while employees contribute a full 12% to their EPF, a portion of the employer’s contribution is diverted to the pension fund.

The pensionable salary on which contributions are calculated currently has a cap of ₹15,000. However, this cap is under review and could be raised to ₹21,000, allowing higher pension benefits in the future.

Advantages of the 2025 Scheme

The latest version of the EPFO pension scheme introduces a range of new and improved benefits:

- Increased Monthly Pension: ₹9,000 monthly payout enhances post-retirement financial stability.

- Family Benefits: In case of the pensioner’s death, family members like the spouse and children are entitled to continue receiving pension benefits.

- Support for Orphans: Children can receive the pension until they turn 25.

- Disability Pension: Employees who become disabled while working are eligible for pension support.

- Widow’s Pension: The spouse is entitled to receive a pension for life or until remarriage.

- Minimum Pension Guarantee: Even with lower lifetime contributions, a basic pension amount is assured.

- Inflation Adjustment: Future pensions may be linked to inflation and adjusted accordingly.

Notable Changes and New Rules

The 2025 update also introduces a series of administrative and technical changes aimed at simplifying the process and making it more transparent:

- The minimum monthly pension has been raised to ₹9,000.

- The pensionable salary ceiling might be revised to ₹21,000.

- Employees now have the option to contribute towards a higher pension based on their actual salary rather than the capped limit.

- Pension applications can now be made online via the official EPFO portal.

- Linking of the pension account with the Universal Account Number (UAN) is mandatory.

- KYC verification, including Aadhaar, PAN, and bank details, must be digitally verified.

- Pensions will be automatically credited to the beneficiary’s bank account each month.

- Enhanced guidelines have been introduced to define eligibility for widow and dependent pensions.

Applying for the EPFO Pension

Thanks to recent digitization efforts, the application process has become user-friendly and fully online. Here’s a step-by-step guide:

- Visit the EPFO’s official website: http://www.epfindia.gov.in.

- Log in using your UAN, password, and captcha code.

- Navigate to the “Online Services” section and select “Pension Claim (Form 10D).”

- Enter your personal, employment, and bank account details.

- Upload supporting documents such as Aadhaar, PAN, service certificate, and bank passbook.

- Submit the application and make a note of the reference number for tracking.

Documents You’ll Need

To ensure your application proceeds smoothly, gather the following documents:

- Aadhaar Card

- PAN Card

- Bank passbook

- Employment certificate

- UAN details

- Nomination form (for family claims)

- Passport-sized photograph

Possible Challenges and Considerations

Despite the benefits, the scheme does face some hurdles in its implementation:

- Financial Burden: Employers may find the increased contribution rates difficult to sustain.

- Lack of Awareness: Many employees may not be fully informed about their pension entitlements.

- Digital Divide: Rural and less-digitized areas may experience delays in the scheme’s rollout.

- Service Record Discrepancies: An incomplete employment history could affect pension calculations.

To address these issues, the EPFO is conducting awareness campaigns and offering online tools to check eligibility and lodge complaints.

Final Notes

The EPFO Pension Scheme 2025 represents a progressive leap toward better financial planning for India’s private-sector workforce. With the increase in the monthly pension to ₹9,000 and improved digital services, the scheme aims to provide a reliable safety net for employees after retirement. Workers are encouraged to review their service records, update KYC information, and apply well in advance to enjoy a secure and dignified retirement.

Mangesh Garg is a passionate writer known for captivating stories that blend imagination and reality. Inspired by travel, history, and everyday moments, He crafts narratives that resonate deeply with readers