In a landmark development that could bring much-needed relief to lakhs of retirees, the Employees’ Pension Scheme (EPS) is all set for a comprehensive revamp. Senior pensioners may soon receive up to ₹9,000 more per month as the government gears up to overhaul the existing system. If implemented, this could mark one of the biggest reforms in India’s pension sector in decades.

With rising inflation and increased healthcare costs, many senior citizens have found it challenging to survive on their existing meagre pensions. The proposed revision aims to correct this long-standing issue and offer a more dignified post-retirement life.

What Is the Employees’ Pension Scheme and Why Is It Being Revised?

Launched in 1995, the Employees’ Pension Scheme (EPS) is a retirement benefit managed by the Employees’ Provident Fund Organisation (EPFO). It was introduced to offer private-sector employees a steady income post-retirement. However, over time, EPS has come under fire for its low pension payouts, especially for those who retired before 2014.

Now, the government is looking to breathe new life into the scheme. The primary goals of the revision include:

- Enhancing financial security for senior citizens

- Adjusting payouts in line with the rising cost of living

- Expanding the coverage and ensuring more inclusivity

- Introducing digital processes to ease claim settlements

Key Highlights of the Proposed EPS Scheme Revision

Here are some major updates likely to be introduced under the revised EPS scheme:

- Monthly pensions may increase by up to ₹9,000

- Wider eligibility to include more beneficiaries

- Option for higher pension contributions to continue

- Simplified documentation for pensioners

- Digital verification and smoother disbursement

- Retroactive benefits under review for pre-2014 retirees

- Launch of a centralized grievance redressal system

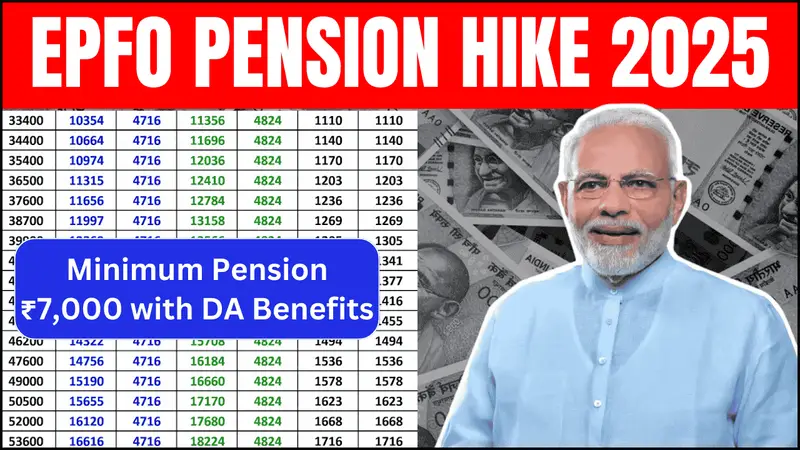

Current EPS Pension Structure vs Proposed Hike

To grasp the potential impact of the revision, here’s a comparison of existing pension amounts with the proposed hike:

| Category of Pensioners | Current Monthly Pension (Approx) | Proposed Monthly Pension (Approx) | Increase (₹) |

|---|---|---|---|

| Retired Pre-2014 | ₹1,000 – ₹3,000 | ₹8,000 – ₹12,000 | ₹7,000 – ₹9,000 |

| Retired Post-2014 | ₹3,500 – ₹6,000 | ₹10,000 – ₹14,000 | ₹6,500 – ₹8,000 |

| Widows/Dependents | ₹1,000 – ₹2,500 | ₹6,000 – ₹8,000 | ₹5,000 – ₹6,000 |

| Disabled Pensioners | ₹1,500 – ₹3,000 | ₹7,000 – ₹9,000 | ₹5,500 – ₹6,000 |

| Minimum Pensioners | ₹1,000 | ₹7,000 | ₹6,000 |

| Higher Wage Contributors | ₹5,000 – ₹7,000 | ₹12,000 – ₹15,000 | ₹7,000 – ₹8,000 |

| Voluntary Retirement Cases | ₹2,000 – ₹4,000 | ₹9,000 – ₹11,000 | ₹7,000 |

This proposed hike promises a significant uplift in pension amounts, particularly for those struggling with inadequate monthly income.

Who Will Benefit from the EPS Revision?

The benefits of the revised EPS will be widespread, particularly for the following groups:

- Private sector retirees under EPFO

- Pre-2014 pensioners drawing minimal pensions

- Widows, dependents, and differently-abled individuals

- Higher wage earners who opted for increased contributions

- Retirees who pursued legal remedies for pension upgrades

This move also comes as a relief to many pensioners who have actively protested or approached the judiciary for justice.

Challenges Faced by EPS Pensioners

For years, pensioners under the EPS scheme have faced multiple hurdles. These include:

- Unrealistically low monthly payouts

- Cumbersome and confusing procedures

- Lack of awareness regarding higher pension options

- Delayed pension disbursal

- Weak grievance redressal mechanisms

- Minimal communication from EPFO

These issues have sparked several protests and legal interventions over the past decade, highlighting the urgency for reform.

Legal Developments and Supreme Court Verdict

The push for EPS reform gained momentum after some significant court rulings. The Supreme Court’s decision allowing eligible EPS members to opt for higher pensions based on their actual salary was a major victory for retirees.

Key directives include:

- EPFO must permit joint applications by pensioners and their employers

- Pension calculations should consider actual salary contributions, not just the wage cap

- Deadlines have been imposed for submitting higher pension claims

These legal developments set the foundation for the current proposed overhaul.

Projected Financial Implications for the Government

Naturally, implementing such a wide-scale reform involves a hefty price tag. Here’s what the financial burden might look like:

| Particulars | Estimated Annual Cost (₹ Crore) | Remarks |

|---|---|---|

| Increase in Pension Disbursement | ₹40,000 – ₹50,000 | Based on the final approved hike |

| Administrative and Tech Upgrades | ₹3,000 | For digital pension processing |

| Retroactive Pension Adjustments | ₹10,000 | For pre-2014 pensioners |

| Grievance Redressal Infrastructure | ₹500 | Centralized system development |

| Legal Compliance & Settlements | ₹1,200 | Related to pending court cases |

| Awareness & Communication Campaigns | ₹300 | Public outreach and education programs |

| Total Estimated Burden | ₹55,000 – ₹65,000 | On central exchequer annually |

While substantial, this expense is seen as a worthy investment in the welfare of senior citizens.

Expected Timeline and Next Steps

Here’s the projected timeline for the rollout of the revised EPS scheme:

- Q2 2025: Government to finalize policy framework

- Q3 2025: Cabinet approval and EPFO notification

- Q4 2025: Implementation and disbursal of revised pensions

- Early 2026: Feedback and refinement phase

How Can Pensioners Avail of the Higher EPS Pension?

To ensure you don’t miss out, follow these steps:

- Update KYC details with EPFO

- Check eligibility as per the Supreme Court ruling

- File a joint option form with your employer if needed

- Track deadlines on the EPFO portal regularly

- Maintain records such as wage slips and PF contributions

Being proactive can help pensioners navigate the process and claim what’s rightfully theirs.

Final Thoughts

The upcoming EPS revision is more than just a pension hike—it’s a recognition of the contributions made by India’s workforce. For many elderly citizens, it’s a long-awaited step towards dignified retirement.

As the government moves ahead with the reforms, pensioners should remain informed, complete the necessary paperwork, and prepare for a brighter, more secure future.

Stay updated with official EPFO circulars and notifications to ensure you don’t miss out on this opportunity.

Mangesh Garg is a passionate writer known for captivating stories that blend imagination and reality. Inspired by travel, history, and everyday moments, He crafts narratives that resonate deeply with readers